Empower your trading operations with cutting-edge DataOps and AI/ML solutions. We specialize in transforming raw financial data into clean, structured formats, enabling precise, real-time trading decisions. By leveraging advanced data engineering, analytics, and automation, we help trading desks optimize strategies and maintain a competitive edge in the dynamic world of algorithmic trading.

Key Features

1: Data Preprocessing

-

- Cleaning and normalizing raw stock, index, and options data for consistency.

- Removing outliers and filling missing values to enhance accuracy.

- Ensuring compatibility with trading platforms and APIs.

2: Backtesting Frameworks

-

- Designing robust environments for strategy validation.

- Simulating trading scenarios with historical data to evaluate performance.

3: Real-Time Data Integration

-

- Establishing high-performance pipelines for live market feeds.

- Supporting seamless integration of third-party APIs and data streams.

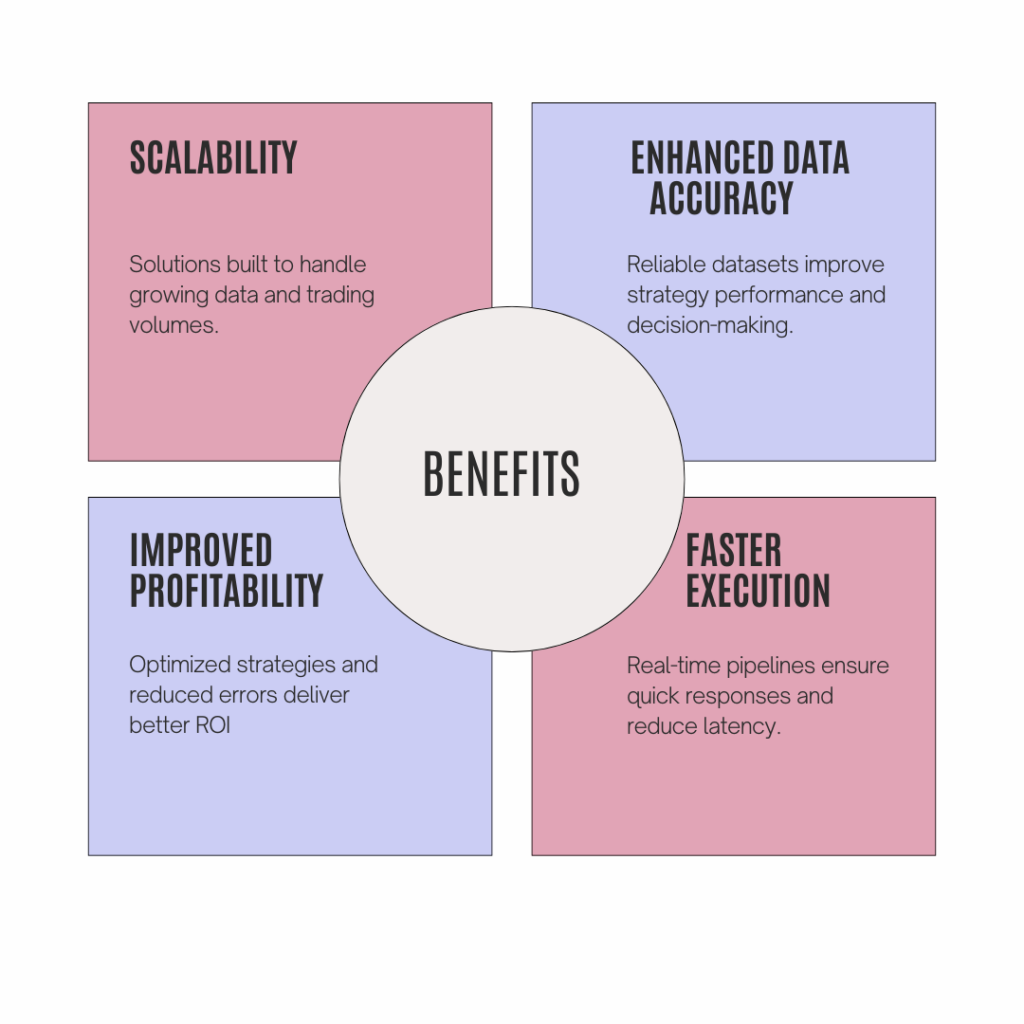

Benefits

Use Cases

- Intraday Trading Optimization: Supporting rapid decision-making with preprocessed data for short-term trades.

- Multi-Leg Option Strategy Backtesting: Validating complex strategies using cleaned historical data.

- Real-Time Arbitrage Detection: Monitoring market streams to capture arbitrage opportunities instantly.

Our Methodology

Dashboard service abstract concept vector illustration. Online reporting mechanism, key performance indicators, dashboard service tool, data metrics, information management abstract metaphor.

1: Data Collection: Aggregate raw market data from multiple sources.

2: Data Cleaning: Normalize, clean, and preprocess data for analysis.

3: Pipeline Development: Build real-time pipelines for seamless data integration.

4: Algorithm Development: Create trading strategies tailored to specific conditions.

5: Backtesting: Evaluate strategies using metrics like ROI and maximum drawdown.

6: Deployment: Launch validated strategies in live markets with real-time monitoring.

7: Optimization: Continuously refine strategies based on performance data.

Tools & Technologies

- Programming Languages: Python, SQL

- Libraries: Pandas, NumPy, SciPy

- Backtesting Frameworks: PyAlgoTrade, Backtrader

- Cloud Platforms: AWS, Azure for scalable data storage and processing

- Broker APIs: Integration with platforms like Interactive Brokers, Zerodha

- Visualization Tools: Tableau, Power BI for reporting and analytics

Business Cases

1: Intraday Strategy Optimization

-

- Challenge: Delays in processing intraday data caused missed opportunities.

- Solution: Implemented a real-time data pipeline that reduced processing time by 70%.

- Result: Increased profitability by 15%.

2: Multi-Leg Option Strategy Validation

-

- Challenge: Lack of clean data hindered options strategy backtesting.

- Solution: Processed 5 years of options data and built custom analytics.

- Result: Improved strategy accuracy and execution by 20%.

Client Testimonial

Rigel’s expertise in real-time strategy deployment and monitoring transformed our trading operations. Their services and solutions are reliable, efficient, and impactful. – Senior Manager, Algorithmic Trading Firm.

Get Started Today

Ready to revolutionize your trading strategies with advanced DataOps and AI/ML solutions?

Contact us now to explore how we can accelerate your success in algorithmic trading.